Therefore life insurance premiums are not tax deductible on your individual tax return. If a business purchases the life insurance and is not the beneficiary of the policy payout the premiums are tax deductible as a business expense.

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg

Distributions From S Corps Can Fund Life Insurance Premiums Bsmg

However if the premiums of your life insurance policy are paid for by an employer the payments may be deductible from the corporations income.

Tax on life insurance premiums. However if you are a business owner and you pay life insurance premiums on behalf your employees your expenses may be deductible. No sales tax is added or charged. Provided that the policy is not an ira or a roth plan the limit is 25 of the employers contribution amount in addition to forfeitures.

Tax treatment of life insurance premiums. Heres a look at what the canada revenue agency requires. As an individual when you pay life insurance premiums they are not deductible on your income tax return.

Life insurance premiums paid by an employer are tax deductible to the employer as a business expense except when the business is itself the beneficiary of the policy. Businesses carry many kinds of insurance and may carry several different types of life insurance. Deductible employer paid life insurance premiums.

However if the business is the beneficiary such as in corporate owned life insurance coli or bank owned life insurance boli the tax consequences may be different. Whether youre an individual or a business owner its essential that you consult a licensed accountant for any tax related questions as they can offer the most accurate advice based on your situation. This coverage however must be considered incidental according to irs guidelines.

Life insurance premiums are not tax deductible. These premiums are also not tax deductible. Your super fund can claim the refund on your premiums and then pass it on to you.

Life insurance premiums under most circumstances are not taxedie. Generally speaking when the beneficiary of a life insurance policy receives the death benefit this money is not counted as taxable income and the beneficiary does not have to pay taxes on it. If such an insurance policy is provided for you as part of your compensation it could.

These types fall into the following categories. Premiums are usually deductible to your super fund when premiums are paid from your pre taxed income. These life insurance premiums will be tax deductible.

For the most part life insurance premiums are not tax deductible but there are certain situations where they can be.

Tax Implications In Life Insurance Bfsi Blogs

Tax Implications In Life Insurance Bfsi Blogs

Take Advantage Of Are Life Insurance Premiums Tax Deductible

Take Advantage Of Are Life Insurance Premiums Tax Deductible

Whole Life Insurance How It Works

Whole Life Insurance How It Works

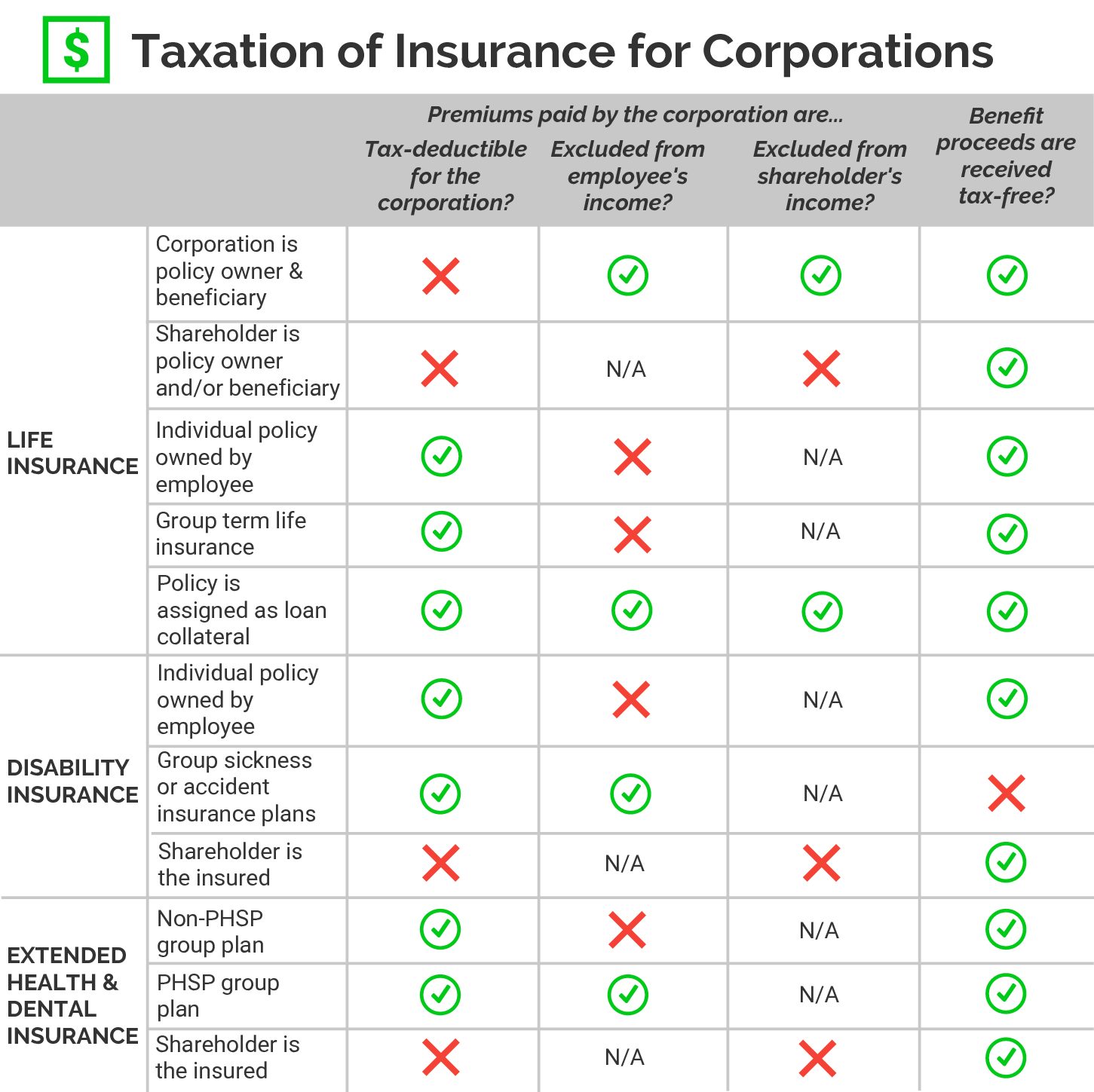

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Taxation Of Insurance For Corporations Kelowna Accounting Solutions

Here S All You Need To Know About The Taxability Of Life Insurance

Here S All You Need To Know About The Taxability Of Life Insurance

Are Life Insurance Premiums Tax Deductible Haven Life

Are Life Insurance Premiums Tax Deductible Haven Life

Life Insurance Premium Deduction U S 80c Simple Tax India

Life Insurance Premium Deduction U S 80c Simple Tax India

Taxable Benefits Taxable Benefits Life Insurance Premiums

Taxable Benefits Taxable Benefits Life Insurance Premiums

Get Income Tax Deduction On Life Insurance Premium Paid For Adult

Get Income Tax Deduction On Life Insurance Premium Paid For Adult

Understanding Whole Life Insurance Dividend Options

Understanding Whole Life Insurance Dividend Options

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Whether Your Life Insurance Policy Is Eligible For Tax Saving

Need Life Cover Up To 100 Years Here S How To Get It The

Need Life Cover Up To 100 Years Here S How To Get It The

The State Of The Nation Should Epf Tax Relief Be Reduced Next

The State Of The Nation Should Epf Tax Relief Be Reduced Next

Life Insurance Policies Income Tax On Life Insurance Policies

Life Insurance Policies Income Tax On Life Insurance Policies

Puzzled By Life Insurance Coverage Guidance Is In This Article

Puzzled By Life Insurance Coverage Guidance Is In This Article

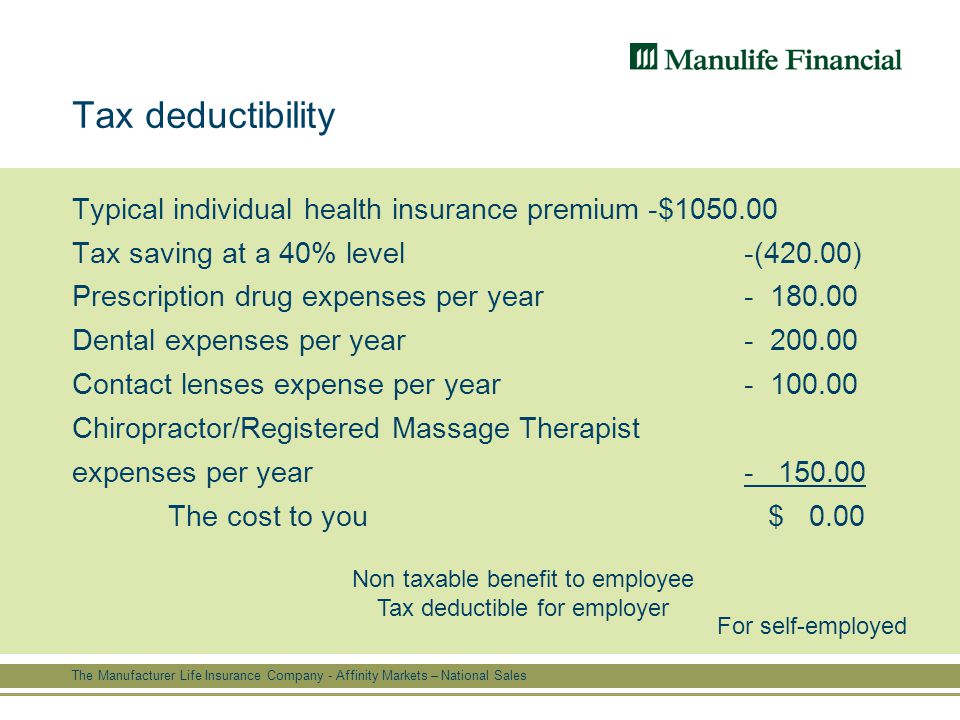

F O O T E R The Manufacturer Life Insurance Company Affinity

F O O T E R The Manufacturer Life Insurance Company Affinity

Not Full Amount But Only Difference Is Liable For Taxation

Not Full Amount But Only Difference Is Liable For Taxation

Life Insurance Permanent Whole Term Universal Return Of Premium

Life Insurance Permanent Whole Term Universal Return Of Premium

Income Tax Benefits In Single Premium Life Insurance Plans

Income Tax Benefits In Single Premium Life Insurance Plans

Buying Life Insurance Lecture No Income Tax Treatment Of Life

Buying Life Insurance Lecture No Income Tax Treatment Of Life

:max_bytes(150000):strip_icc()/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

0 Komentar untuk "Tax On Life Insurance Premiums"