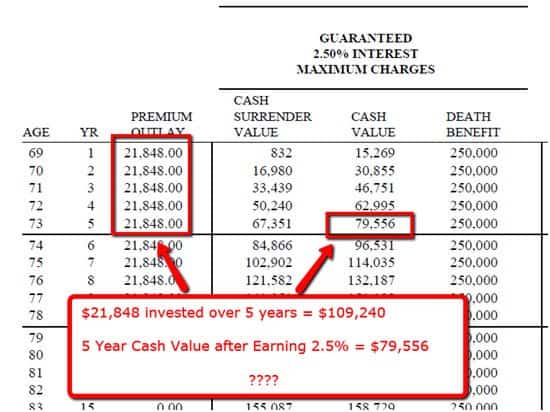

A life insurance policy surrender may trigger certain tax consequences that youll need to know to avoid getting into trouble with the irs. Surrender charges can be substantial during the first few years of the policy.

Solved 25 The Annual Increase In The Cash Surrender Valu

Solved 25 The Annual Increase In The Cash Surrender Valu

Once again even if the life insurance policys cash value is depleted to zero by ongoing policy loans the lapse of the policy and the lack of any remaining cash value at the end doesnt change the tax consequences of surrendering a life insurance policy with a gain since in essence the gains were simply borrowed out earlier and.

Tax consequences of surrendering a life insurance policy. A life insurance policy loan is not taxable as income as long as it doesnt exceed the amount paid in premiums for the policy. This process is called surrendering the policy. In general the cash reserve within an exempt policy can accumulate on a tax deferred basis and the death benefit payable under the policy is tax free.

But there are certain. Most of the time proceeds arent taxable. Unless you make premium payments that can be claimed as a tax deduction which is somewhat rare the money you pay your life insurance provider has already been taxed.

Taxes on surrendered life insurance policies. In part one we talked about the tax attributes of life insurance. If you surrender your policy or your policy lapses the loan plus.

Tax implications for the cash surrender of life insurance if your life insurance policy has cash value you can take out your money whenever you want through a cash surrender. Because of this it is generally not advantageous to cancel a new policy. Policy owners should always consult with a qualified tax adviser if they are concerned about possible taxation upon surrender of a life insurance policy.

What happens when you cash in a life insurance policy. Tax rules for surrendering a life insurance policy. Surrender charges some life insurance policies especially variable universal and universal life insurance policies may have surrender charges for the first 10 15 years of the policy.

The taxation of a surrendered cash value life insurance policy is very simple. Q i am considering surrendering a life insurance policy what tax implications should i be aware of. Life insurance isnt a fun topic to think about but it can protect your loved ones in the event you were to pass away.

This is part two of a series on tax and insurance. The insurance company will cancel your policy and mail you a check for your account balance.

What Is Tax Liability If I Surrender My Insurance Policy Before

What Is Tax Liability If I Surrender My Insurance Policy Before

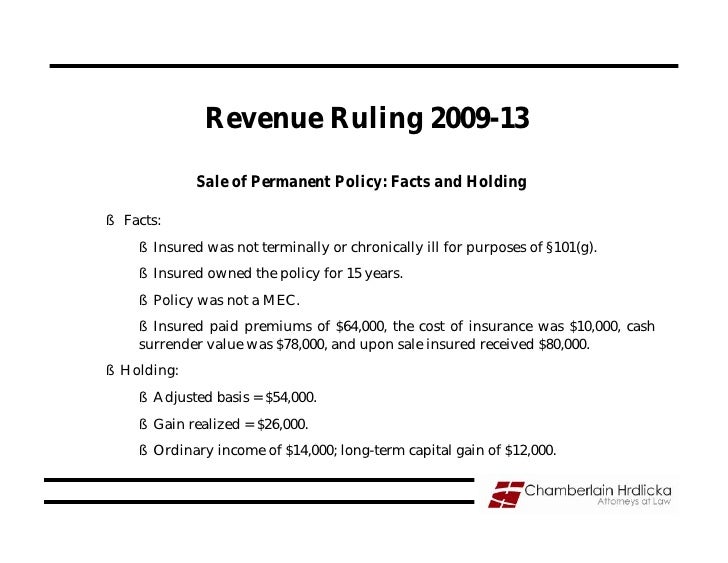

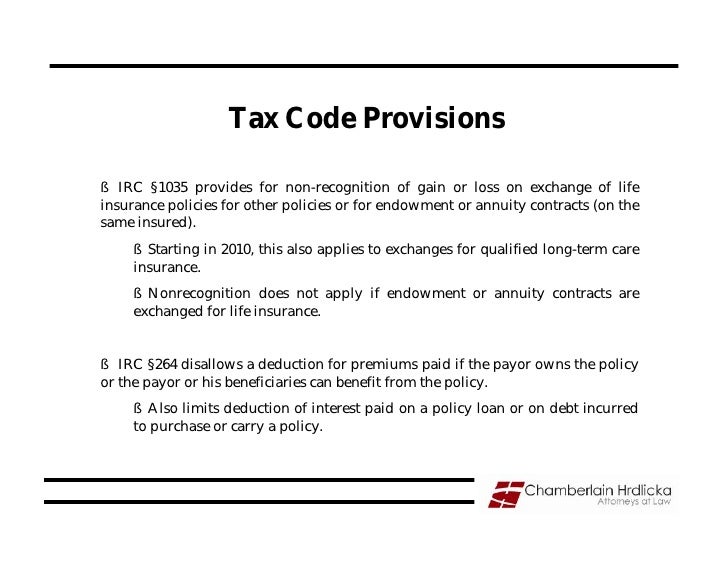

Income Tax Consequences Of The Sales And Surrenders Of Life Insurance

Income Tax Consequences Of The Sales And Surrenders Of Life Insurance

How To Cancel Life Insurance 13 Steps With Pictures Wikihow

How To Cancel Life Insurance 13 Steps With Pictures Wikihow

Whole Life Insurance The Essential Guide

Whole Life Insurance The Essential Guide

Tax Aspects Of A Partial Surrender On A Section 1035 Pages 1

Tax Aspects Of A Partial Surrender On A Section 1035 Pages 1

7 1 Adjustable Life What Is It Flexible Premium

7 1 Adjustable Life What Is It Flexible Premium

Surrender A Universal Life Insurance Policy Wealth Management

Surrender A Universal Life Insurance Policy Wealth Management

Income Tax Consequences Of The Sales And Surrenders Of Life Insurance

Income Tax Consequences Of The Sales And Surrenders Of Life Insurance

Lic Jeevan Anand 149 Features Benefits And Maturity Calculator

Lic Jeevan Anand 149 Features Benefits And Maturity Calculator

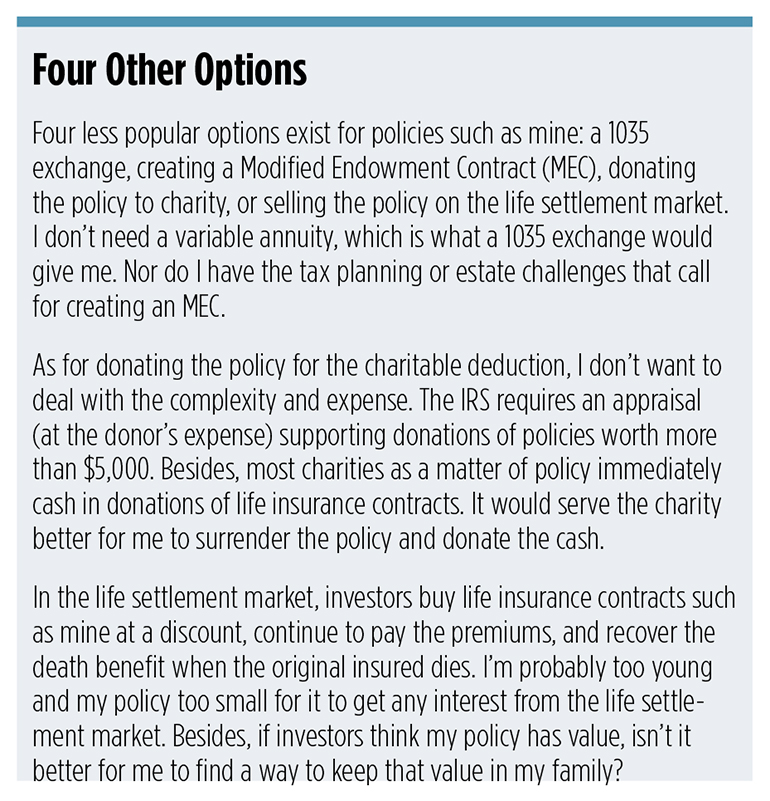

Life Settlements Guide Selling A Life Insurance Policy

Life Settlements Guide Selling A Life Insurance Policy

/Borrowing-money-from-a-life-insurance-policy-57afcb4d5f9b58b5c248b3c6.jpg) Borrowing From A Life Insurance Policy

Borrowing From A Life Insurance Policy

Tax Implications When You Discontinue Life Insurance Policy

Tax Implications When You Discontinue Life Insurance Policy

When To Cash In A Life Insurance Policy The Dough Roller

When To Cash In A Life Insurance Policy The Dough Roller

Life Insurance When To Sell A Policy Financial Planning

Life Insurance When To Sell A Policy Financial Planning

Cashing In Your Life Insurance Policy

Cashing In Your Life Insurance Policy

:max_bytes(150000):strip_icc()/GettyImages-1176591592-9a66639b87274cd98137c838478b69ae.jpg) Cashing In Your Life Insurance Policy

Cashing In Your Life Insurance Policy

When Are Life Insurance Benefits Taxed Texas Republic Life

When Are Life Insurance Benefits Taxed Texas Republic Life

Tax Benefit And Tds On Life Insurance U S 10 10d And 80c

Tax Benefit And Tds On Life Insurance U S 10 10d And 80c

10 Things You Absolutely Need To Know About Life Insurance

10 Things You Absolutely Need To Know About Life Insurance

Form Of Individual And Survivorship Life Insurance Application

Form Of Individual And Survivorship Life Insurance Application

Life Insurance Policy What You Stand To Benefit And Lose On

Life Insurance Policy What You Stand To Benefit And Lose On

Income Tax Consequences Of The Sales And Surrenders Of Life Insurance

Income Tax Consequences Of The Sales And Surrenders Of Life Insurance

0 Komentar untuk "Tax Consequences Of Surrendering A Life Insurance Policy"