We offer 10 15 20 or 30 year options so contact an advisor to see which may be right for you. The foundation of all life insurance is the death benefit which pays an income tax free amount to your beneficiaries when the insured person passes.

Products issued by thrivent are available to applicants who meet membership insurability us.

Thrivent life insurance company. It also offers a pair of different benefits. If your finances get tight but your insurance needs are as real as ever term life insurance may offer a simple solution. The thrivent life insurance company offers a wide range of products and services from life insurance policies to health insurance products to charitable planning.

For costs and complete details of coverage contact your thrivent financial representative. Citizenship and residency requirements. Insurance products issued or offered by thrivent financial the marketing name for thrivent financial for lutherans appleton wi.

Cash value life insurance explained. Learn about the difference between term permanent life insurance to see which may be right for you. Its typically the most affordable way to get coverage for a set period of time.

Of the two types of permanent life insurance universal life insurance is a little more flexible. In a nutshell cash value life insurance is a type of permanent life insurance with a cash value savings component. Products issued by thrivent are available to applicants who meet membership insurability us.

According to the company. Citizenship and residency requirements. Thrivent financial provides christian term life insurance plans.

At thrivent financial customers with a universal life insurance policy can make adjustments as their life changes. Not all products are available in all states. Insurance products issued or offered by thrivent financial the marketing name for thrivent financial for lutherans appleton wi.

Not all products are available in all states. For example policyholders can pay more premiums at certain times or less at times when theyre strapped for cash. Thrivent life insurance company if you are looking for insurance for your home car or life then our insurance quotes service can give you quotes to help you find what you need.

With term you can lock in rates for 10 15 20 or 30 years. Thrivent financial offers christian life insurance plans. Long term care coverage annuities iras investments a credit union and several financial services are all available to its members.

Term life insurance contracts have exclusions limitations reductions of benefits and terms under which the contract may be continued in force or discontinued.

Senior Benefit Services Inc Medicare Supplement Carriers

Senior Benefit Services Inc Medicare Supplement Carriers

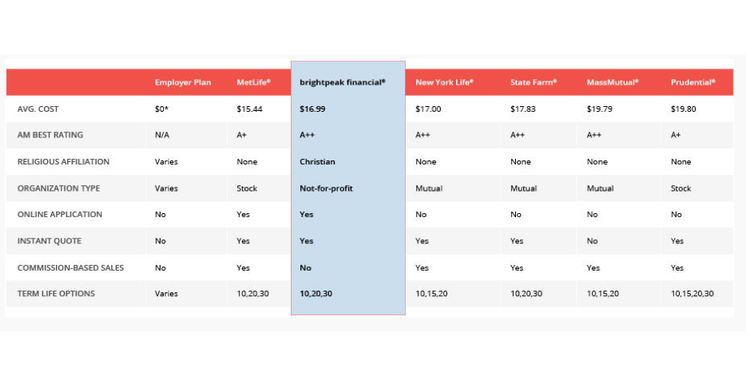

32 Best Term Life Insurance Companies In 2020

32 Best Term Life Insurance Companies In 2020

Brightpeak Review Trustworthy Term Life Insurance Myfinance

Brightpeak Review Trustworthy Term Life Insurance Myfinance

Thrivent Logo And History Logo Engine

Thrivent Logo And History Logo Engine

Workers Compensation Laborer Insurance Job Financial

Workers Compensation Laborer Insurance Job Financial

Https Www Icmifasiaoceania Coop Wp Wp Content Uploads 2016 12 3 Thrivent En With Notes Pdf

Falls Financial Associates Thrivent Financial Financial

Falls Financial Associates Thrivent Financial Financial

Thrivent Embroiled In Legal Battle With State Of California Twin

Thrivent Embroiled In Legal Battle With State Of California Twin

Thrivent Financial Organization Logo Editorial Stock Photo Image

Thrivent Financial Organization Logo Editorial Stock Photo Image

Permanent Life Insurance For Christians Thrivent Financial

Your Guide To Making Practical Decisions When A Loved One Dies

Your Guide To Making Practical Decisions When A Loved One Dies

How Do I Register At Thrivent Com 5280 Associates Wealth Management

How Do I Register At Thrivent Com 5280 Associates Wealth Management

Thrivent Financial Competitors Revenue And Employees Owler

Thrivent Financial Competitors Revenue And Employees Owler

Variable Universal Life Thrivent Financial For Lutherans

Variable Universal Life Thrivent Financial For Lutherans

Thrivent Financial Medicare Supplement Review 2020

Thrivent Financial Medicare Supplement Review 2020

Member Benefits And Activities Value Of Partnership Thrivent

Top 5 Most Anti Christian Anti Life Insurance And Financial

Top 5 Most Anti Christian Anti Life Insurance And Financial

Life Happens Partner Companies Life Happens

Life Happens Partner Companies Life Happens

Thrivent Series Fund Inc 2019 Prospectus Summary 497k

Thrivent Series Fund Inc 2019 Prospectus Summary 497k

0 Komentar untuk "Thrivent Life Insurance Company"