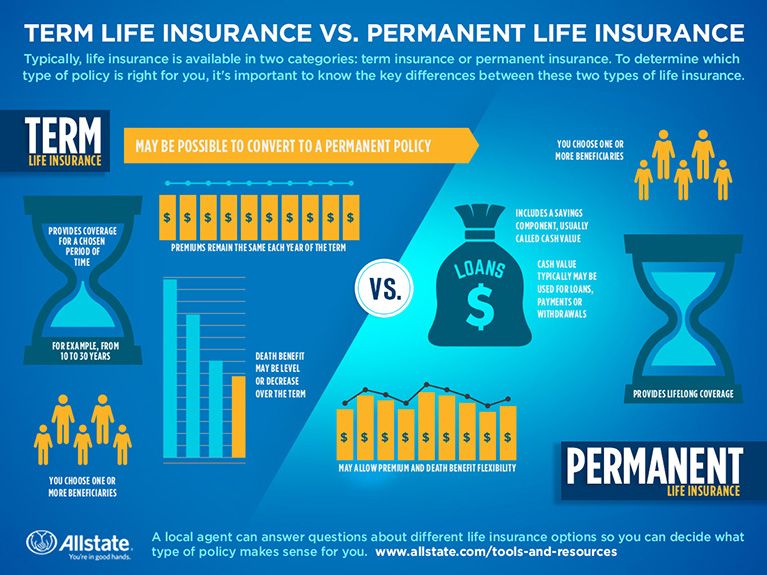

The advantages of term life insurance lie within its flexibility and cost effectiveness. Term life insurance is the simplest form of life insurance.

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

5 Reasons Why Term Life Insurance Is Best Insurance Blog By Chris

The advantages and disadvantages to purchasing term life insurance can be significant so this article will help you understand them.

Term life insurance advantages. So lets get to it. Here are the advantages and disadvantages of the three most common types of life insurance. Term life insurance offers four important advantages.

Our list of 9 term life insurance advantages and disadvantages. With term you can purchase the amount insurance that you need without paying more than you can afford. If you die within the time period defined in the terms the insurance company will pay your beneficiaries the face.

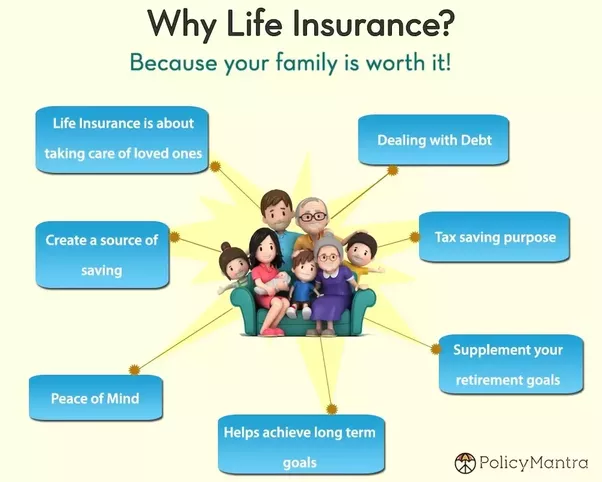

With so many controversies concerning buying term life insurance i wanted to present a few ideas for you to ponder and decide for yourselfsome are saying term life is a waste of money while others argue you should buy term and invest the difference. A term insurance policy is a time bound insurance plan that requires you to pay a certain premium towards your policy at regular intervals. Term plans are essential.

It gives you a life cover to protect your familys finances in your absence. Term life insurance can be a good fit particularly for young families on a budget looking for coverage for a set amount of time. 10 advantages of term life insurance although some agents and advisors believe that whole life insurance is always a superior product term life insurance does have an important role to play in a.

Advantages of term life insurance. Advantages and disadvantages of life insurance by type now that weve covered the more general advantages and disadvantages of life insurance lets talk about how the policy you choose can shake things up. Advantages and disadvantages of term life insurance.

It offers death protection insurance at a fixed rate of payment for a limited specific period of time. However once your term ends so does your coverage and you wont see any of the money you paid. In the unforeseen event of your demise the policys sum assured is awarded to your nominee.

Term is the cheapest form of life insurance you can buy. Apart from providing financial security to the loved ones there are many other benefits of having a term insurance plan. To find the best coverage for your lifestyle take the time to compare life insurance companies.

A term life insurance offers insurance coverage in form of death benefit to the beneficiary of the policy in case of uncertain demise of the insured person.

Term And Permanent Life Insurance

Term And Permanent Life Insurance

Maturity Benefits What You Need To Know When Buying Insurance

Maturity Benefits What You Need To Know When Buying Insurance

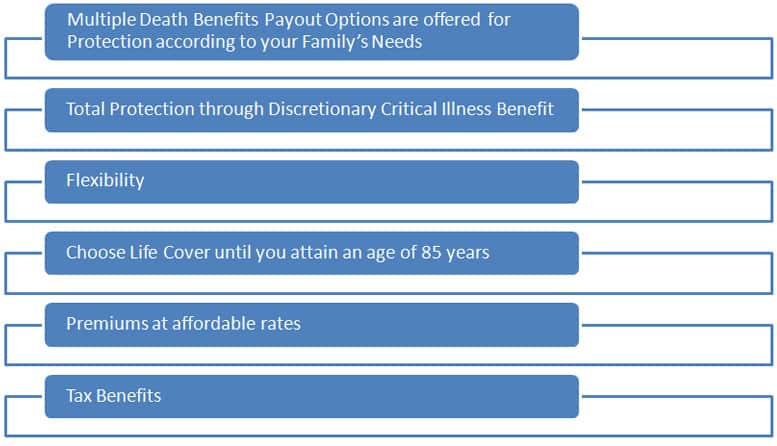

Bharti Axa Life Flexi Term Plan

Bharti Axa Life Flexi Term Plan

Advantages Of Whole Life Insurance Policies Vs Term Life Policy

Advantages Of Whole Life Insurance Policies Vs Term Life Policy

Whole Life Insurance How It Works

Return Of Premium Life Insurance Benefits Advantages

Return Of Premium Life Insurance Benefits Advantages

Is Life Insurance A Good Investment Option

Is Life Insurance A Good Investment Option

Layering Life Insurance Policies Fidelity Investments

Layering Life Insurance Policies Fidelity Investments

Term Life Insurance Insurance Select Group

Term Life Insurance Insurance Select Group

Term Life Insurance Quotes Online Canada Dave Johnson Medium

Term Life Insurance Quotes Online Canada Dave Johnson Medium

Cash Value Life Insurance Voya Financial

Cash Value Life Insurance Voya Financial

Term Insurance Vs Traditional Life Insurance Which Policy To Take

Term Insurance Vs Traditional Life Insurance Which Policy To Take

About Wfl Insurance Sarasota Insurance Services

About Wfl Insurance Sarasota Insurance Services

Advantages Of A Whole Life Insurance Policy Honey Insurance

Advantages Of A Whole Life Insurance Policy Honey Insurance

The Advantages And Disadvantages Of Early Retirement Term Life

The Advantages And Disadvantages Of Early Retirement Term Life

Advantages Of Limited Premium Payment Term Insurance Plans Ecomsweb

Advantages Of Limited Premium Payment Term Insurance Plans Ecomsweb

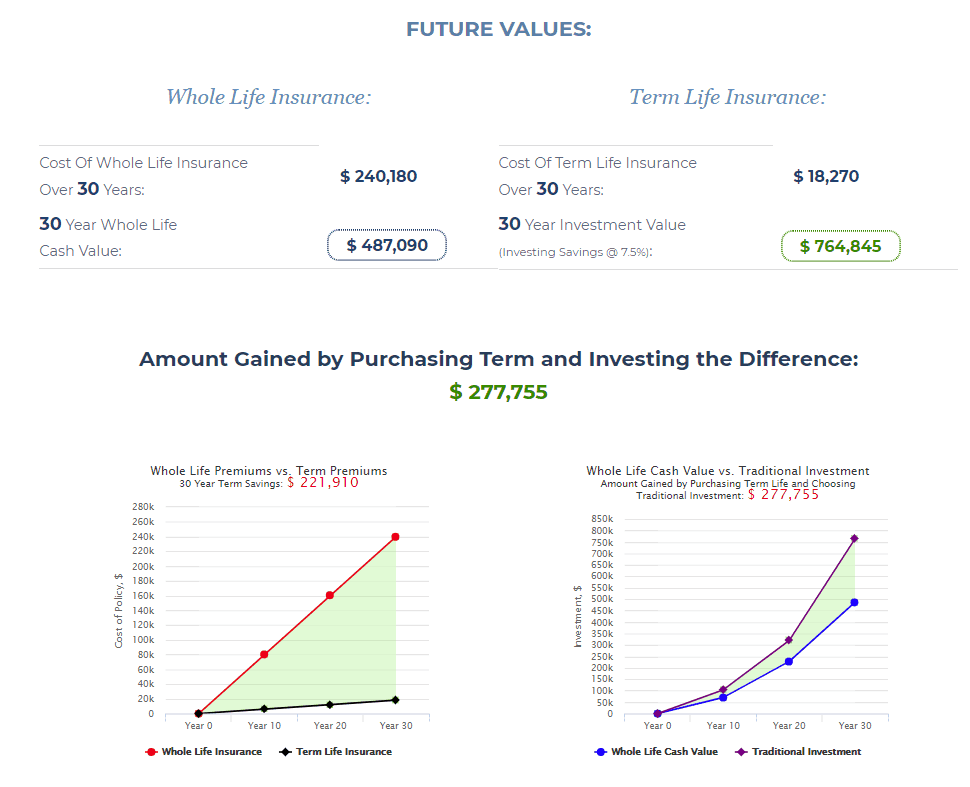

Term Life Vs Whole Life Insurance Daveramsey Com

Term Life Vs Whole Life Insurance Daveramsey Com

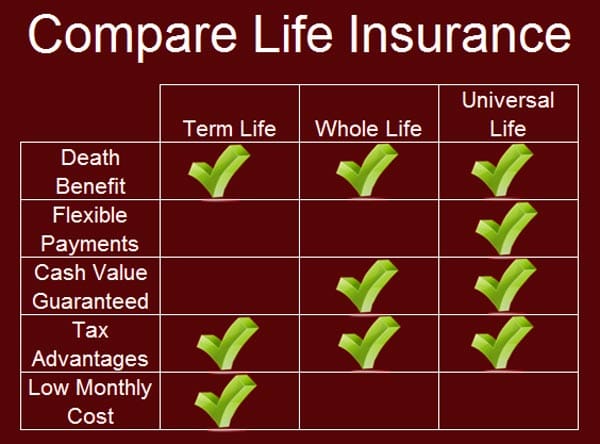

Different Types Of Life Insurance Explanation The Ultimate Guide

Different Types Of Life Insurance Explanation The Ultimate Guide

Certificate Of Deposit Advantages And Disadvantages

Whole Vs Term Life Insurance Policygenius

Whole Vs Term Life Insurance Policygenius

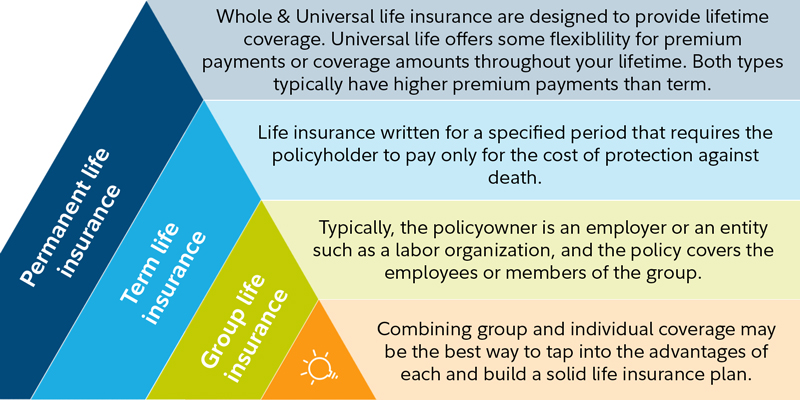

Permanent Life Insurance 101 What You Need To Know Allstate

Permanent Life Insurance 101 What You Need To Know Allstate

The Benefits Of Term Life Insurance

The Benefits Of Term Life Insurance

0 Komentar untuk "Term Life Insurance Advantages"