Split dollar life insurance definition. Think of split dollar life insurance as a win win strategy between two parties.

Split Dollar Arrangement Transamerica

Split Dollar Arrangement Transamerica

Split dollar when properly set up is a mutually beneficial arrangement in which an owner and non owner split and share a life insurance contract.

Split dollar life insurance arrangements. Split dollar life insurance arrangements if you are looking for quotes on different types of insurance then our service can help you find what you are looking for. For split dollar life insurance arrangements entered into before the date of publication of final regulations in cases where the value of current life insurance protection is treated as an economic benefit provided by a sponsor to a benefited person under a split dollar life insurance. They have mutual benefits for employees and employers.

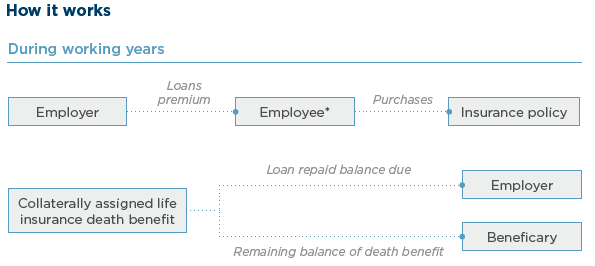

This guide explains how split dollar policies works the best companies and more. Administrative procedural and miscellaneous split dollar life insurance arrangements. In a split dollar plan an employer and employee execute a written agreement that outlines how they will share the premium cost cash value and death benefit of a permanent life insurance policy.

They are employed in circumstances where more than one party requires the benefits provided by a life insurance policy. A plan that allocates the costs and benefits of a life insurance policy in a specific manner by contract in order to maximize tax advantages for the employer and employee. Split dollar life insurance arrangements if you are looking for quotes on different types of insurance then we can give you insurance quotes that will help you find what you are looking for.

Split dollar life insurance policies are one of the best ways to insure executives and key people to your company. Split dollar insurance arrangements sharing the benefits of a permanent life insurance policy as a concept the applications of split dollar insurance arrangements are great and diverse. Purpose the treasury department and internal revenue service irs are reviewing the.

A split dollar plan is not about a specific life insurance product but rather is a contractual strategy for using life insurance. Here you will find a definitive guide to the strategy including how and when it works the tax implications merits and obstacles and what your next steps should be. The comprehensive guide to split dollar life insurance the world of split dollar life insurance agreements is a complicated one where old rules and regulations collide with newly issued rules and regulations leaving planners wondering what to do next.

Split Dollar Life Insurance Accounting

Split Dollar Life Insurance Accounting

What Is Split Dollar Life Insurance And How Does It Work

What Is Split Dollar Life Insurance And How Does It Work

Fillable Online Regulation 164754 01 Split Dollar Life Insurance

Fillable Online Regulation 164754 01 Split Dollar Life Insurance

Capital Split Dollar Article By Lindsey Mcgonegal Issuu

Capital Split Dollar Article By Lindsey Mcgonegal Issuu

Split Dollar Life Insurance Arrangements The Lafayette Life

Split Dollar Life Insurance Arrangements The Lafayette Life

Business Owners Have You Considered Split Dollar Critical Illness

Business Owners Have You Considered Split Dollar Critical Illness

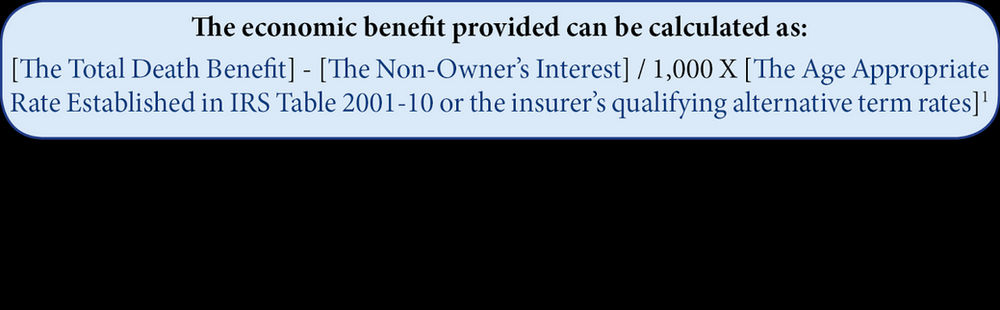

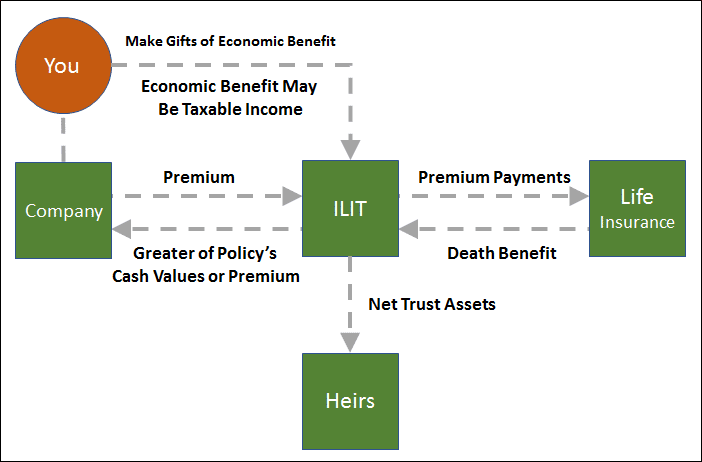

Economic Benefit Regime Private Split Dollar

Economic Benefit Regime Private Split Dollar

Split Dollar Plans For Better Executive Compensation Strategy

Split Dollar Plans For Better Executive Compensation Strategy

Split Dollar Insurance And The Closely Held Business By Larry

Split Dollar Insurance And The Closely Held Business By Larry

Split Dollar Life Insurance Arrangements Pdf Free Download

Split Dollar Life Insurance Arrangements Pdf Free Download

Split Dollar Life Insurance Arrangements For Small Businesses And

Split Dollar Life Insurance Arrangements For Small Businesses And

A Neca Split Dollar Arrangement

A Neca Split Dollar Arrangement

Split Dollar Life Insurance Funding You Mean People Still Do That

Split Dollar Life Insurance Funding You Mean People Still Do That

Split Dollar Life Insurance Chapter 42 Employee Benefit

Split Dollar Life Insurance Chapter 42 Employee Benefit

Presented By Life Insurance Planning In A Low Interest Rate

Presented By Life Insurance Planning In A Low Interest Rate

Truenorth Explains The Loan Regime Split Dollar Arrangement

Truenorth Explains The Loan Regime Split Dollar Arrangement

Chapter 37 Tools Techniques Of Life Insurance Planning 37

Chapter 37 Tools Techniques Of Life Insurance Planning 37

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Using Economic Benefit Or Loan Regime

Split Dollar Life Insurance Chapter 42 Employee Benefit

Split Dollar Life Insurance Chapter 42 Employee Benefit

What Is Split Dollar Life Insurance Term Life Insurance Usa

What Is Split Dollar Life Insurance Term Life Insurance Usa

Split Dollar Life Insurance Arrangements Pdf Free Download

Split Dollar Life Insurance Arrangements Pdf Free Download

What Is A Split Dollar Life Insurance Policy The Complete Guide

What Is A Split Dollar Life Insurance Policy The Complete Guide

Split Dollar Life Insurance Funding You Mean People Still Do That

Split Dollar Life Insurance Funding You Mean People Still Do That

Navigating The Sarbanes Oxley Loan Prohibitions Alice Murtos

Navigating The Sarbanes Oxley Loan Prohibitions Alice Murtos

0 Komentar untuk "Split Dollar Life Insurance Arrangements"