What type of risk are you. Steps to get life insurance as a high risk applicant.

Life Insurance Underwriting Risks Sampo Group Annual Report 2012

Life Insurance Underwriting Risks Sampo Group Annual Report 2012

1 credit risk management in life insurance companies r.

Risk in life insurance. 3 types of risk in insurance are financial and non financial risks pure and speculative risks and fundamental and particular risks. Opinion expressed in this presentation are mine and not necessarily of my employer. Fundamental risks are the risks mostly emanating from nature.

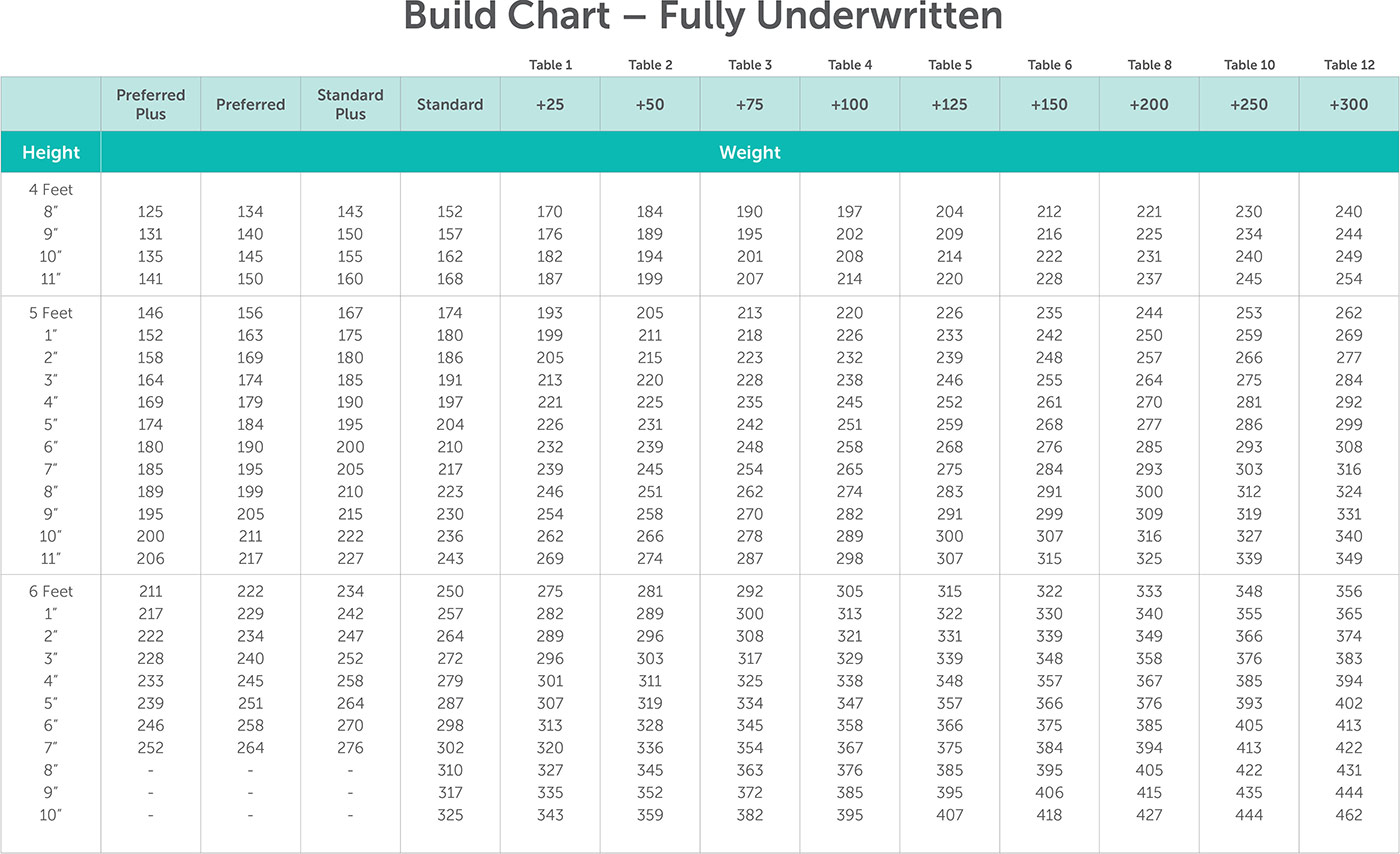

Changing from standard to preferred risk. It doesnt make sense to allow someone with a greater probability of death to pay the same as someone who likely wont die for another handful of decades. The more risk factors you have the more you pay.

Kannan appointed actuary sbi life insurance company ltd mumbai 400 021 7th global conference of actuaries feb 2005. Limitations or restrictions may apply. People in each risk group will generally share similar characteristics.

Life insurance risk types. An insurance risk class is a way for insurers to underwrite policies based on ones belonging to a particular risk group. Policies offered by bestow are provided by north american company for life and health insurance an insurance carrier rated a superior by am.

Pure risks are a loss only or at best a break even situation. Life insurance quotes provided by bestow agency llc dba bestow insurance services in ca who is the licensed agent. Risk management in life insurance 1.

They are convinced by the experience theyve been through and the agents theyve dealt with that they will just have to do without. Whether you know it or not you are a risk in the eyes of insurance companies. Know all about the risk coverage associated with term insurance policiescheck out features benefits riders claim process and reviewsapply for best term plans online that will perfectly suit your needs and protect your family.

Life insurance quotes policy risks from life insurance quotes wiz. Financial risks can be measured in monetary terms. What type of risk are you.

Risk management in life insurance part 1 sonjai kumar vice president business risk aviva india life insurance disclaimer. Even risky candidates can get insured it just takes a little know how when it comes to finding a policy thats flexible and can meet their needs. Risk life insurance has devoted 100 of our business to impaired risk and high risk life insurance because tragically there are hundreds of people every day who just give up.

Based on the risk that the applicant carries the adviser can find insurers willing to provide coverage or tailor the policy around the risk. Some factors to consider when determining risk. Life insurance companies decide how much your life insurance policy will cost based on risk factors.

Personal Risk Factors Influencing Your Life Insurance Rates Full

Personal Risk Factors Influencing Your Life Insurance Rates Full

Risk Management In Life Insurance Companies Evidence From Taiwan

Risk Management In Life Insurance Companies Evidence From Taiwan

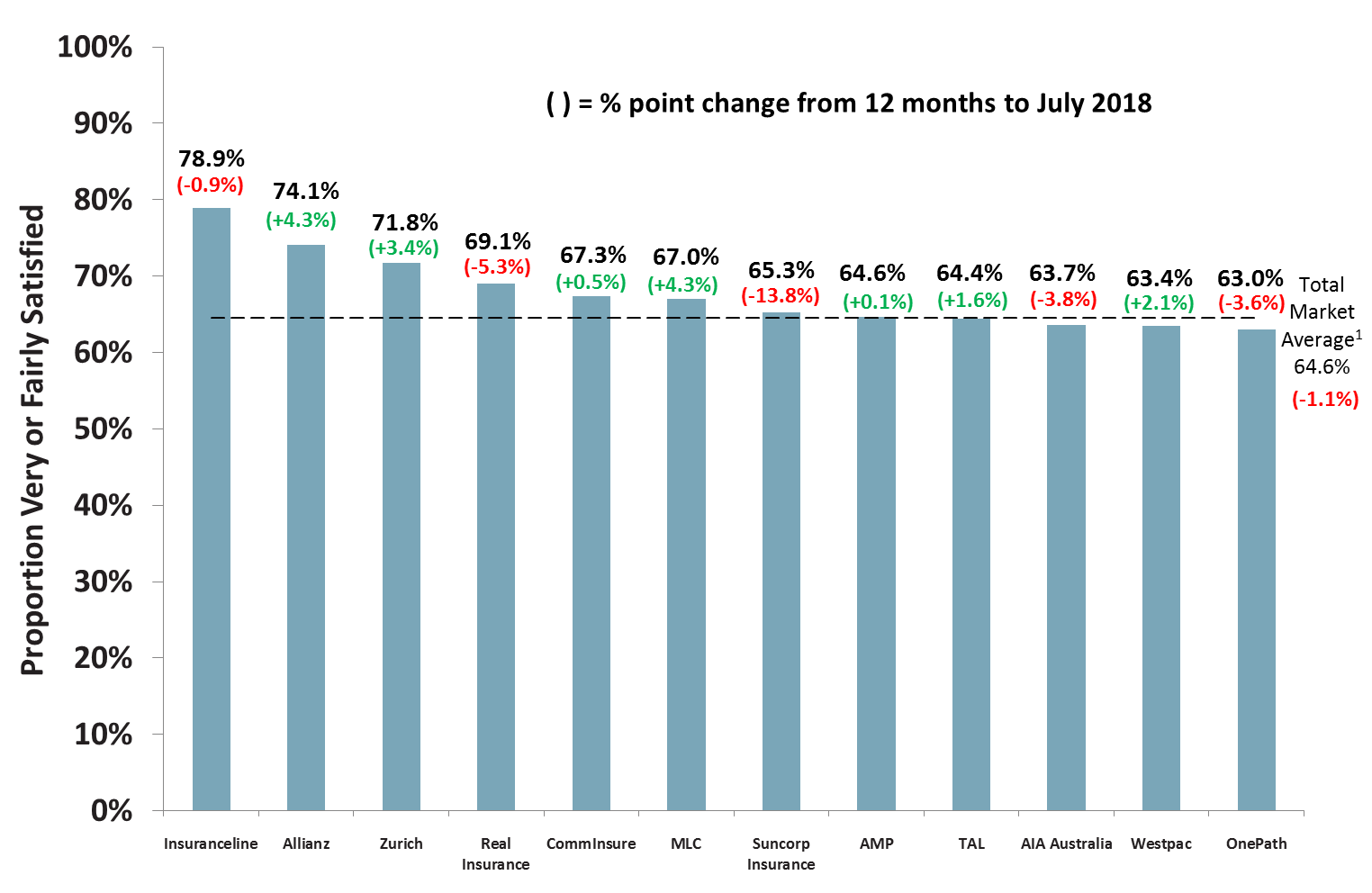

Satisfaction With Risk And Life Insurance Continues To Decline

Satisfaction With Risk And Life Insurance Continues To Decline

Mortality Risk Management Individual Life Insurance Ppt Video

Mortality Risk Management Individual Life Insurance Ppt Video

Need Life Cover Up To 100 Years Here S How To Get It The

Need Life Cover Up To 100 Years Here S How To Get It The

1 Topic 19 Life Insurance Risk Factors Lifestyle Occupation

1 Topic 19 Life Insurance Risk Factors Lifestyle Occupation

Best Things To Avoid Low Risk Cover Of Life Insurance Plans

Best Things To Avoid Low Risk Cover Of Life Insurance Plans

High Risk Life Insurance Companies Insurechance

High Risk Life Insurance Companies Insurechance

Age 100 Tax Issue With Outliving Life Insurance Mortality Tables

Age 100 Tax Issue With Outliving Life Insurance Mortality Tables

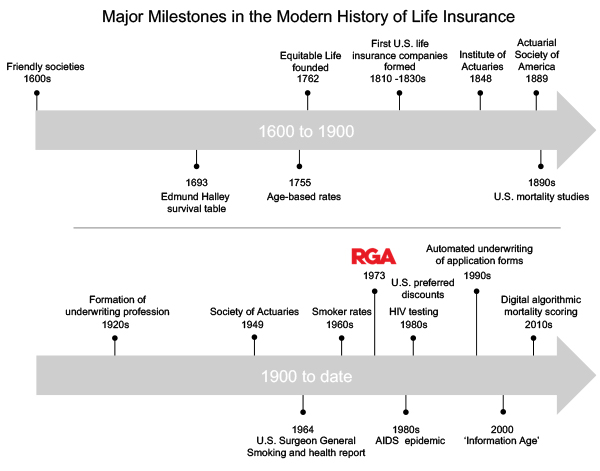

Past Present And Future Of Risk Factors The History Of Life

Past Present And Future Of Risk Factors The History Of Life

Cancer Survivor Impaired Risk Term Life Insurance Text Background

Cancer Survivor Impaired Risk Term Life Insurance Text Background

Insurance Risk Management Life Insurance Disability Property

Insurance Risk Management Life Insurance Disability Property

Life Insurance Impaired Risk Effortless Insurance

Life Insurance Impaired Risk Effortless Insurance

Risk Insurance And Life Insurance Future Needs

Risk Insurance And Life Insurance Future Needs

What Is The Real Money Laundering Risk In Life Insurance High

What Is The Real Money Laundering Risk In Life Insurance High

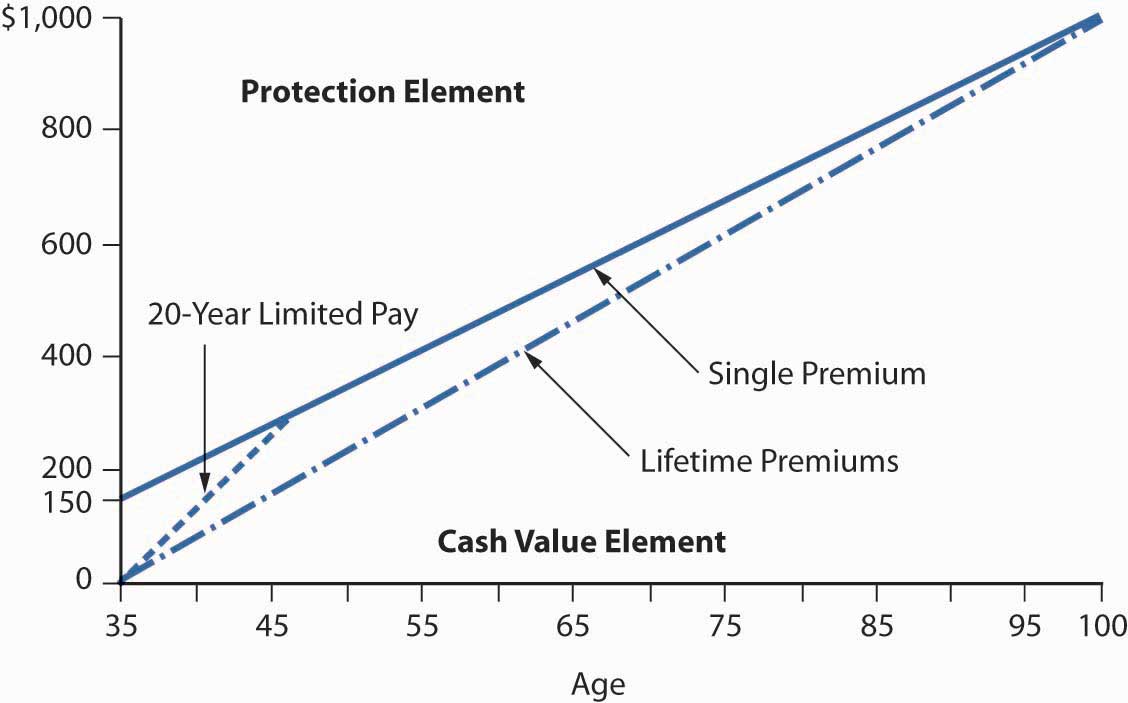

Mortality Risk Management Individual Life Insurance And Group

Mortality Risk Management Individual Life Insurance And Group

What Are The Risk Factors That Affect Buying Life Insurance Quotacy

What Are The Risk Factors That Affect Buying Life Insurance Quotacy

School Symbol Insurance Risk Finance Life Insurance Insurance

School Symbol Insurance Risk Finance Life Insurance Insurance

Risks Ahead Life Insurance Could Be Good For Your Health

Risks Ahead Life Insurance Could Be Good For Your Health

What Does An Insurance Underwriter Do

What Does An Insurance Underwriter Do

Learning Cyber Insurance Lessons From Life Insurance Underwriting

Learning Cyber Insurance Lessons From Life Insurance Underwriting

0 Komentar untuk "Risk In Life Insurance"