For all policies with non guaranteed elements a statement that the policy will be illustrated or non. The medical condition of the person the policy is attached to is a major factor.

What You Need To Know About 20 Year Term Life Insurance And Whom

What You Need To Know About 20 Year Term Life Insurance And Whom

Instant cash offer is made available to qualified applicants it is not intended to represent a bid or an actual offer to purchase a life insurance policy.

Requirements for life insurance policy. The life insurance policy. The life settlement application is a tool intended to assist harbor life in the evaluation and qualification of life insurance policies. Eligibility requirements for a viatical or life settlement are based on two criteria.

The life insurance policy contract must be available to review if not available a duplicate should be ordered from the life insurance carrier. You also have to select a life insurance policy that you can afford meaning the premium is something you can pay on time for the duration of the policy. So if you purchase a 20 year term 250000 life insurance policy and you die five years later your beneficiaries would receive the 250000.

Regardless of the reason for undertaking a life settlement here are a few things to keep in mind when selling a life insurance policy. However some states allow spouses to take out a life insurance policy on a spouse or minor child 15 or younger without his consent. The life expectancy of the insured.

You will probably not qualify for a life insurance policy if you try to get a death benefit that is too large in comparison with your risk level. There are many reasons why they would replace their policy with a new oneto obtain more or less coverage to lower the premium. Submission requirements for life insurance policies all life insurance filings must include a signed actuarial memorandum describing the policy and the reserve and nonforfeiture value methodology in accordance with sections 83 7 23 and 83 7 25.

Term life insurance covers you for a set period such as 10 15 20 or 30 years. Life insurance policy considerations. What is term life insurance.

For many people life insurance is not a one time purchase. All of the information completed in the two stages of the medical life insurance exam combined with the statistical longevity data and the information on the life insurance application is used to determine if you will be accepted for your life insurance policy or not and what the annual premium will be. A policy will pay your loved ones the face value of your policy if you die during that time.

Before jumping into a life insurance policy learn what decisions you have to make and what you can do to reduce your premiums before you apply. Due to the signature requirements and medical exams it would be extremely difficult for a person to take a life insurance policy out on someone else without the insured being aware of it. Generally the older the policyholder is the more likely the policy will meet the eligibility requirements for the sale of a policy.

Different Types Of Life Insurance Policies How Much Do You Need

Different Types Of Life Insurance Policies How Much Do You Need

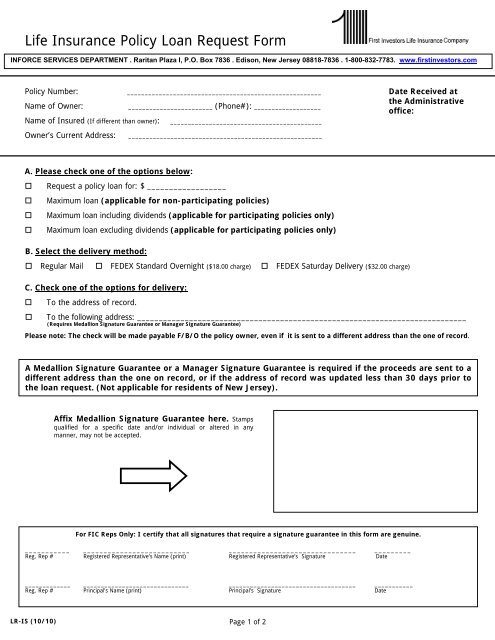

Life Insurance Policy Loan Request Form First Investors

Life Insurance Policy Loan Request Form First Investors

Sample Letter Format For Surrender Of Life Insurance Policy

Sample Letter Format For Surrender Of Life Insurance Policy

How Much Life Insurance Do I Need Typical Coverage Amounts

How Much Life Insurance Do I Need Typical Coverage Amounts

9 Mistakes To Avoid For Divorce And Life Insurance No Exam

9 Mistakes To Avoid For Divorce And Life Insurance No Exam

Universal Life Insurance Definition

Universal Life Insurance Definition

Is It A Good Idea To Cash Out Your Life Insurance Policy

Is It A Good Idea To Cash Out Your Life Insurance Policy

How To Choose Best Life Insurance Policy In India Planmoneytax

How To Choose Best Life Insurance Policy In India Planmoneytax

Finding The Best Group Life Insurance Trusted Choice

Finding The Best Group Life Insurance Trusted Choice

Chapter 14 Standard Life Insurance Contract Provisions And Options

Chapter 14 Standard Life Insurance Contract Provisions And Options

What Is A Reinstatement Clause In A Life Insurance Policy

What Is A Reinstatement Clause In A Life Insurance Policy

Pdf Lapsation In Life Insurance Policies

Pdf Lapsation In Life Insurance Policies

Does A Life Insurance Policy Cover Suicide As A Cause Of Death

Does A Life Insurance Policy Cover Suicide As A Cause Of Death

Term Life Insurance Definition

Term Life Insurance Definition

What To Do If Your Term Life Insurance Policy Is About To Expire

What To Do If Your Term Life Insurance Policy Is About To Expire

Requirements To Sell A Life Insurance Policy Harbor Life Settlements

Requirements To Sell A Life Insurance Policy Harbor Life Settlements

An Outline Of The Various Types Of Life Insurance Policies

An Outline Of The Various Types Of Life Insurance Policies

Form Of Application Icc15 Axa Life

Form Of Application Icc15 Axa Life

The Best Life Insurance Companies In 2020 Policygenius

The Best Life Insurance Companies In 2020 Policygenius

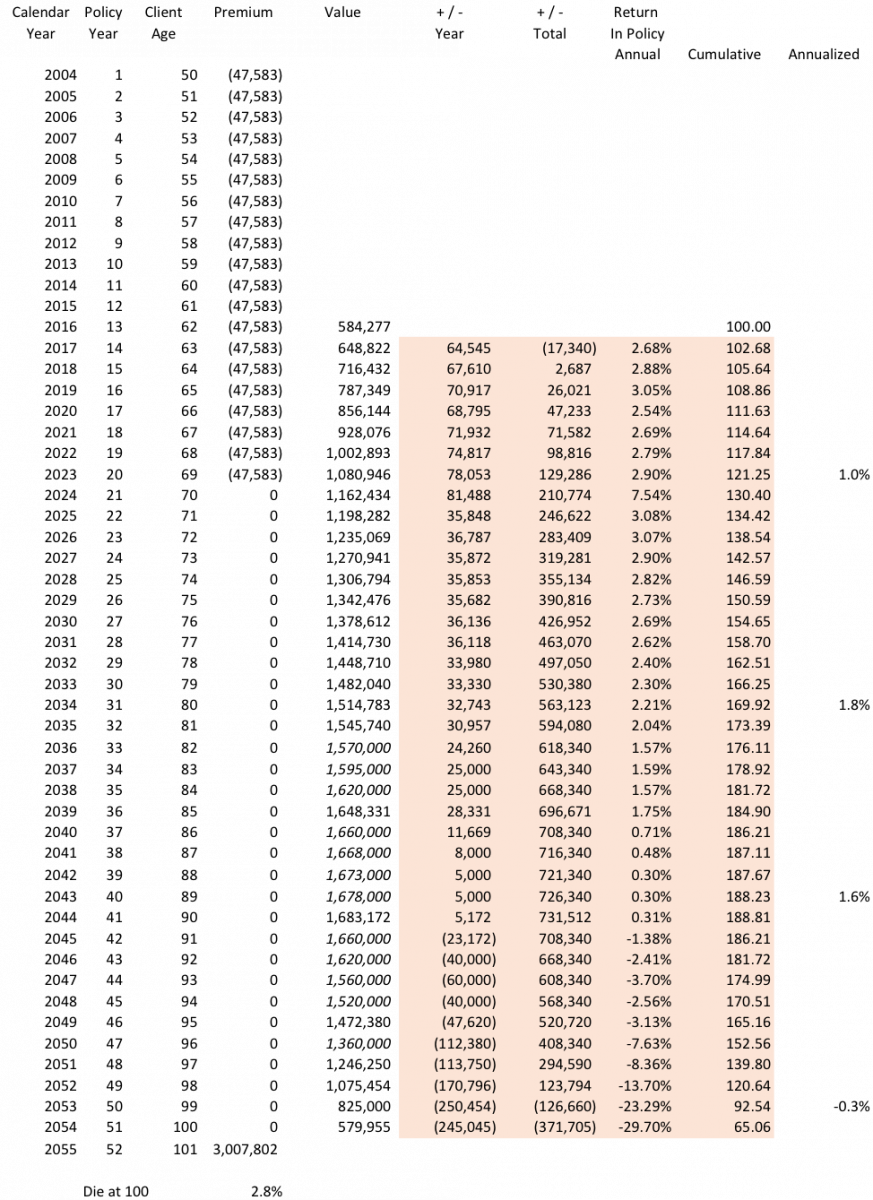

Life Insurance Policies That Don T Make Sense Three Examples Md

Life Insurance Policies That Don T Make Sense Three Examples Md

Analyze The Beneficiaries Of Life Insurance Policy

Analyze The Beneficiaries Of Life Insurance Policy

Fact That Life Insurance Coverage

Fact That Life Insurance Coverage

What Is Guaranteed Universal Life Insurance And How Does It Work

What Is Guaranteed Universal Life Insurance And How Does It Work

0 Komentar untuk "Requirements For Life Insurance Policy"